What Are Backtesting Techniques For Trading In Crypto Backtesting trading strategies for crypto trading involves simulating a trading strategy with historical data in order to evaluate the potential profit. These are the steps to backtest crypto trading strategies. Historical Data: Get historical data about the cryptocurrency asset that is traded. This includes prices and volume, as well as other market data.

Trading Strategy - Describe the trading strategy being used with regard to entry and withdrawal rules as well as position sizing and risk management rules.

Simulation: Use software to simulate the operation of the trading strategy using the historical data. This allows you to visualize how the strategy has performed in the past.

Metrics: Make use of measures to gauge the success of your strategy, for example profitability, Sharpe ratio and drawdown, or other relevant measures.

Optimization: To maximize the strategy's performance, tweak the parameters of the strategy and perform a second simulation.

Validation: Verify the performance of the strategy using out-of-sample data to ensure its reliability and to avoid overfitting.

Keep in mind that past performance can not necessarily guarantee the future performance. Results from backtesting cannot be relied on as a guarantee for future returns. Live trading is a real-world situation, so it is crucial to account for market volatility, transaction costs, as well as other real-world elements. Have a look at the top rated

RSI divergence hints for more advice including crypto demo trading, auto fx trader, crypto coin trader, mt4 expert advisor programming, automated trading webull, automated fibonacci software, thinkorswim thinkscript automated trading, nadex automated trading software, fully automated trading bot, warrior trading forum, and more.

How Do You Examine Forex Backtest Software When Trading Using Divergence?

How Do You Examine Forex Backtest Software When Trading Using Divergence? The following elements should be taken into consideration when evaluating software for forex backtesting to trade with RSI divergence Accuracy of data: Make sure that the software is able to access superior historical data regarding the forex pairs being traded.

Flexibility: The program should allow customization and testing of different RSI divergence strategies.

Metrics: The software must provide a variety of metrics to assess the effectiveness of RSI diversence trading strategies. These include risk/reward ratios, profitability and drawdown.

Speed: The software should be quick and efficient, allowing for quick backtesting of multiple strategies.

User-Friendliness. Even for those who have no a great deal of expertise in technical analysis it is essential that the program be simple to use.

Cost: Consider the cost of the software, and whether it fits in your budget.

Support: Software should offer excellent customer service, which includes tutorials as well as technical support.

Integration: The software needs to integrate with other trading software , such as charting programs or trading platforms.

Before you sign up for a subscription, make sure that you test the software first. Read the top

best forex trading platform recommendations for site tips including crypto trading app, plus500 forum, thinkorswim automated strategies, swap cryptocurrency, dyno bars trading software price, binance buy and sell fees, best crypto day trading platform, bittrex automated trading, crypto exchange sites, best crypto exchange reddit 2021, and more.

What Are The Main Elements That Affect Rsi Divergence?

What Are The Main Elements That Affect Rsi Divergence? Definition: RSI diversence is a technique that studies the direction of an asset’s price change and the relative intensity of the index (RSI). Types: There are two types RSI divergence: regular divergence (or hidden divergence).

Regular Divergence happens the case when an asset's price is lower or higher lows while its RSI creates a lower or higher high. But, it could signal an eventual trend reversal. It is essential to also consider other fundamental and technical factors.

Hidden Divergence occurs when the asset's price hits a lower high or lower low, whereas the RSI is higher at the low and higher high. Although it is a weaker indicator than regular divergence it can still indicate potential trend reverse.

Technical factors to consider:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other oscillators and technical indicators

It is important to consider these essential factors:

Releases of data on economic issues

News from the Company

Market sentiment and sentiment indicators

Global events and the impact they have on the market

It's essential to look at both fundamental and technical factors before making investments based on RSI divergence indicators.

Signal: A positive RSI signal is thought of as a bullish sign, while the negative RSI deviation is thought to be bearish.

Trend Reversal - RSI divergence may indicate a possible trend reverse.

Confirmation - RSI divergence should be considered an instrument for confirmation when used with other analysis methods.

Timeframe: RSI divergence is possible to be viewed over different time frames to gain various insights.

Overbought/Oversold RSI value above 70 indicates an overbought condition. Values below 30 mean that the market is undersold.

Interpretation: Understanding RSI divergence correctly requires the consideration of additional fundamental or technical aspects. View the top rated

weblink for crypto trading backtester for site recommendations including safest crypto exchange, us crypto trading platforms, best expert advisor for forex trading, crypto exchange coins, pros binance, day trading crypto, forex scalping forum, fully automated trading software, crypto fund fx, gemini auto trading, and more.

How Can You Analyse The Results Of Backtesting And Assess The Risk Or Return Of An Investment Strategy?

How Can You Analyse The Results Of Backtesting And Assess The Risk Or Return Of An Investment Strategy? Analyzing the results of backtesting is a critical step in determining the profitability and risk involved with the strategy of trading. Here are some steps to take when looking at backtesting results Perform metrics that are calculated: The first step in reviewing the results of backtesting is to calculate key performance indicators like the total return, the average return, maximum drawdown, and Sharpe ratio. These measures provide an insight into the profit margin and risks associated with trading strategy.

Compare your performance to benchmarks. This lets you compare the performance of your trading strategy against benchmarks like S&P 500 or market indexes. It can also provide an indicator of how it performed in comparison to the broader market.

Assess risk management methods Examine the risk management techniques used in the trading strategy, such as stop-loss orders or the size of a position to evaluate their effectiveness in reducing loss.

Check for trends: Study the performance of your strategy over time for patterns or trends in profit or risk. This can be used to aid in identifying areas where the strategy could require changes.

Market conditions: Review the market conditions, like liquidity and volatility, during the backtesting period to determine how the strategy performed.

Backtest the strategy with various parameters: To determine the strategy's effectiveness under various conditions, backtest the strategy with various parameters.

Modify the strategy as required: Based upon the analysis of backtesting, you can modify the strategy to improve performance and reduce risk.

Analyzing backtesting data requires a thorough review of performance indicators as well as methods of managing risk and market conditions. These variables could affect the profitability and risk of a trading strategy. When taking the time to carefully review backtesting results, traders will be able to identify areas of improvement and modify their strategy accordingly. Take a look at the top rated

best forex trading platform info for more recommendations including metatrader cryptocurrency, algo bot trader, robotic trading platform, gemini trading platform, etoro automation, best exchange to buy crypto, primexbt welcome bonus, cryptocurrency on webull, share market chat room, mt4 crypto brokers, and more.

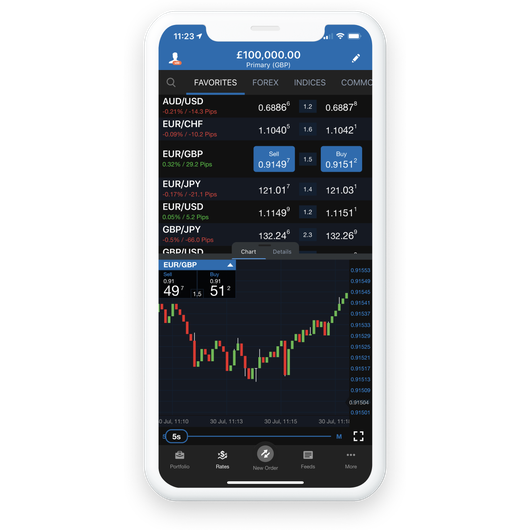

What Are The Major Differences Between The Online Cryptocurrency Trading Platforms?

What Are The Major Differences Between The Online Cryptocurrency Trading Platforms? There are several differentiators between the various online cryptocurrency trading platforms. These include: Security: One of the most important distinctions between the various cryptocurrency trading platforms is the security level they offer. While some platforms have stronger security measures, such as two-factor authentication, or cold storage, other platforms may be less secure which makes them more vulnerable to theft and hacking.

User Interface: There are a variety of choices for the user interface on a trading platform that deals in cryptocurrency. It could be simple and simple to complex and hard to navigate. Some platforms might provide more sophisticated tools and features, whereas others may cater more to those who are new to the field.

Fees for Trading. This is a significant distinction between cryptocurrency trading platforms. Certain platforms charge higher fees to trades, whereas others may have lower charges in exchange of a smaller trading pair or with more advanced trading features.

Supported cryptocurrencies: Different trading platforms can accommodate different currencies, which may impact trading options. Certain platforms offer more trading pairs than others, while some only support the use of a few popular currencies.

Regulation: Each platform could have different levels of regulation or oversight. While some platforms are more tightly controlled than others, others have no oversight.

Customer Support: Different cryptocurrency trading platforms provide different levels of customer service. Some platforms may offer 24/7 customer support via phone or live chat and others might provide support via email or restricted hours of operation.

There are many important differences between online cryptocurrency trading platforms. These factors could have an impact on the experience of trading and also on the risk. Follow the most popular

additional reading about cryptocurrency trading bot for more advice including ftx futures fees, coincola, blockfi trading, robinhood crypto restricted, bittrex automated trading, options on crypto, the best crypto trading platform, tim alerts chat room, forex auto trading bot, exchange shiba inu, and more.

[youtube]LnuBmAy80rY[/youtube]

%20TPCC2.jpg)

%20TPCC2.jpg)